Some think Legacy Fund could be a more effective, innovative tool

Next legislature and governor could provide further direction

From zero to $10.5 billion-plus in a decade-and-a-half.

The state’s Legacy Fund, originally constructed as a “rainy day” fund to help provide a revenue source to cover state expenses after oil and gas revenue disappears, has morphed into a much larger beast: a sovereign wealth fund.

State regulators also now refer to it as such, but some question whether it is really being run as a full-fledged sovereign wealth fund on par with others around the country and world.

Among those with questions is Jamestown’s Brian Lunde. He’s studied sovereign wealth funds since working as a national field director for Jimmy Carter’s presidential campaign in 1976 and throughout the subsequent years as a political consultant in Washington, D.C., including time as an advisor to the George W. Bush administration.

Lunde briefed the governor campaigns of Rep. Kelly Armstrong (R-N.D.) and District 44 Sen. Merrill Piepkorn (D-Fargo) about the Legacy Fund in the lead up to the June 11 primary.

Those briefings included discussions on increased transparency and oversight on investments to ensure they’re being made strategically with clear objectives for North Dakota, both for in-state and out of state investments.

They also included pushing for the State Investment Board (SIB), chaired by the lieutenant governor, to take a more active role in positioning the fund as a sovereign wealth fund.

Strategic reform

Those ideas appear to be gaining some traction.

In an interview before the primary, Armstrong said the first thing to recognize about the Legacy Fund is that it shows how “the state has become addicted to oil money.”

Around 52% of North Dakota’s state budget is now paid for by state oil and gas revenue.

Since being approved by voters and created in 2010, 30% of extraction taxes have gone into the fund.

Armstrong said that while the fund always needs to exist as a replacement revenue stream, there is a “bigger, broader conversation for the legislature” that needs to be had about its direction.

Armstrong also said the SIB and the legislature should take a more active role in setting strategic investment policy for the Legacy Fund.

“The State Investment Board can make the call, they can sit down and say ‘These are the things we care about’ and the legislature can give guidance,” Armstrong said.

He is also concerned that investments aren’t being monitored closely enough, potentially to the state’s detriment.

“Common sense determines that when you have a State Investment Board you can say, ‘Listen, agriculture and energy are the number one and number two industries in North Dakota, and we can get a rate of return without investing in companies that are uniquely situated to dislike agriculture and energy,’” Armstrong said.

Candidate Piepkorn said that while the original purpose of the fund was to potentially sustain the state in lean times post-oil, investing in the future of North Dakota is becoming more important as the fund emerges into a more mature sovereign wealth vehicle.

“I do not believe the Legacy Fund should be used to pay our day-to-day bills, if we had a shortfall or something, that’s why we have a budget,” Piepkorn said.

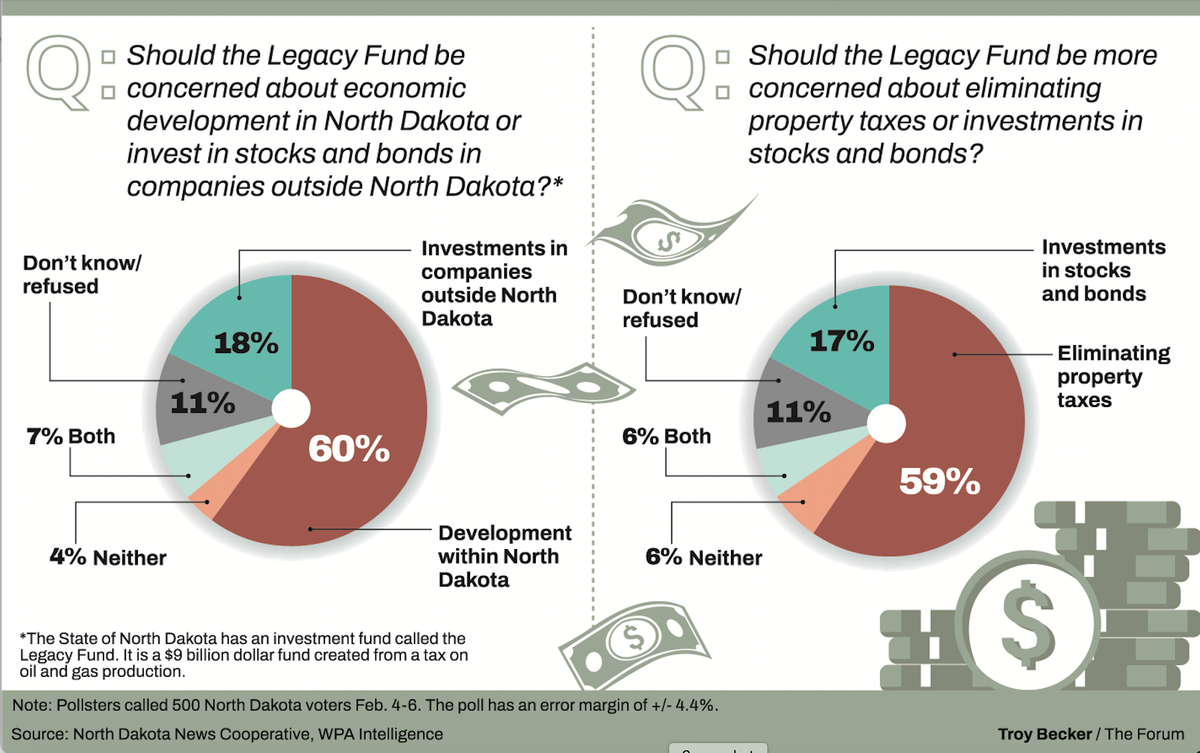

Piepkorn is also not in favor of using Legacy Fund money to get rid of property taxes, which has been floated as a potential initiated measure.

“If we, the legislature, granted every wish that the public had, we could probably get rid of that $10 billion dollar balance in the Legacy Fund in one session,” he said. “I don’t believe that’s a proper and responsible way to address the property tax problem.”

Lunde said the SIB has the power to develop new goals and objectives that can both grow the fund and also invest in a future economy that will eventually fill state coffers once oil and gas revenue dwindles.

Changes underway

Others argue a strategic shift is underway and the SIB has already been provided some of that direction through the legislature’s Legacy Fund and Budget Stabilization Advisory Board.

One aspect of that is the creation of the North Dakota Growth Fund, which shifts Legacy Fund principal directly toward in-state investment, with all investments going out by 2030.

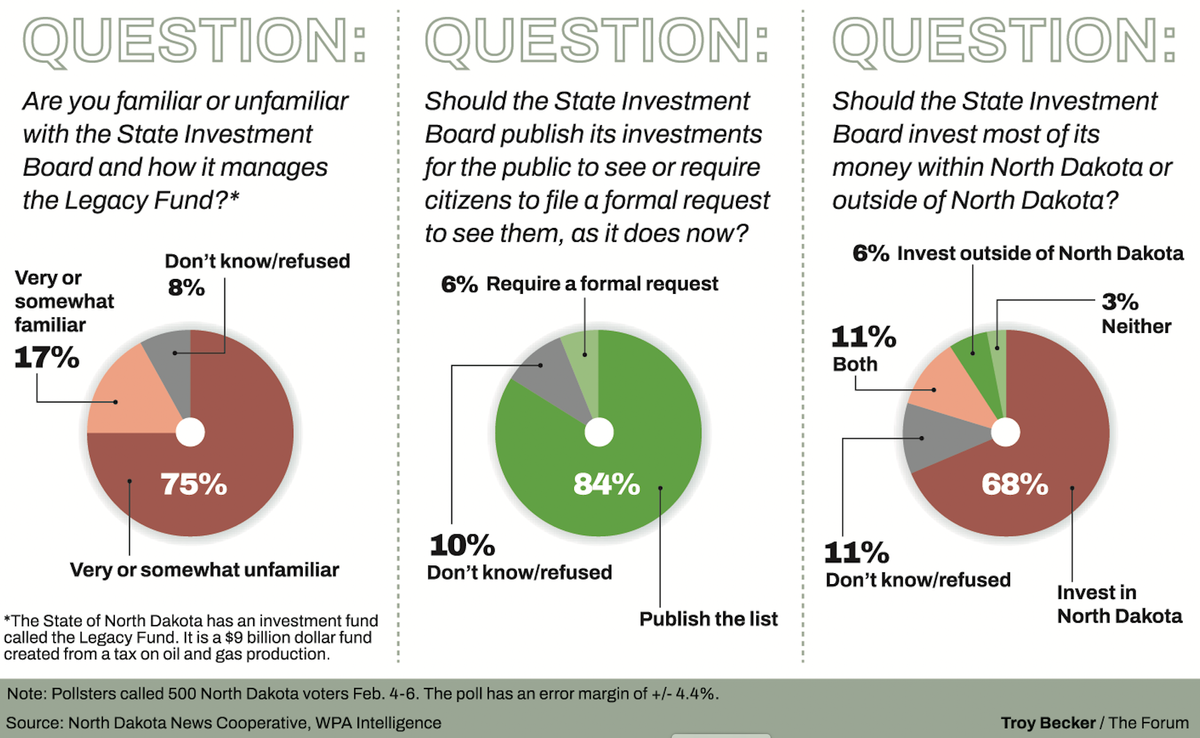

State Treasurer Thomas Beadle, an SIB board member, said it is a “fundamental misunderstanding” to say the SIB is responsible for setting the strategic vision of the Legacy Fund.

“That (legislative) board is the one that sets the investment policy statements, that sets those strategic visions, those goals, those objectives,” Beadle said. “The staff at SIB, it is then their job to execute on that, but (the legislative board) is actually the governing body for the Legacy Fund.”

For the 2023-2025 period, the state budget stands at $19.61 billion. That’s up from $16.94 billion in the previous two-year period, and up from $14.69 billion in the period before that.

With the way the budget is growing, if oil and gas revenue disappeared, the current amount in the Legacy Fund theoretically wouldn’t last long.

“If you think about $10 billion, that’s only two biennia,” said Sen. Jerry Klein (R-Fessenden), chair of the legislature’s Legacy Fund and Budget Stabilization Advisory Board as well as a SIB board member.

Compared to other sovereign wealth funds around the country, the Legacy Fund is still in its infancy. Alaska’s stands at $77 billion, the fund in Texas at $66 billion, New Mexico’s at $44 billion, and Wyoming’s at $23 billion -- all outpacing North Dakota’s fund.

“We’re on our way,” Klein said of building up the fund to similar levels, remarking that it was only in 2017 that earnings from the fund started to be used.

“We have to be careful, we have to be prudent, we have to follow the direction that was given in 2010 by the citizens that said we have to save this for the future,” Klein said.

“This is a long-term investment in North Dakota and it’s going to be a long-term return,” he said

Currently, the legislature can take only 15 percent from the principal during a two-year period if it is really needed to cover shortfalls, and only if two-thirds of the legislature approves.

The Legacy Fund includes the principal – which is the current $10.55 billion – and the earnings off the growth of the fund.

Since 2019, each legislative session has decided how much of the earnings to transfer to the state’s general budget.

The last three disbursements to the general budget were over $455 million, over $871 million and over $486 million, with the legislature then deciding how to use that for various in-state programs.

The latest move by the legislature was to allow 7 percent of the five-year average of earnings to go into the state budget to keep it from trending upward so quickly.

In 2021, the legislature also committed to divert $1.3 billion directly from the Legacy Fund principal toward in-state investment via the North Dakota Growth Fund.

That includes $700 million to infrastructure projects and another $600 million to support new and growing businesses through the North Dakota Growth Fund, with all investments projected to be made by 2030.

So far $89 million has been committed to five funds and four direct co-investments in-state by 50 South Capital with a total of around $40 million of that deployed.

50 South Capital is a private equity and hedge fund investment firm based out of Chicago, but has a North Dakota based team that selects the in-state investments.

On course or adrift?

Lunde believes it may be time to decouple the Legacy Fund from the same body that manages state pension funds, the Retirement and Investment Office (RIO), with the fund under direct oversight of the SIB and an independent board.

“Sovereign wealth funds need their own management system,” Lunde said. “The goals and objectives of a sovereign wealth fund are usually different and not necessarily compatible with the goals and objectives of a pension fund. But we've never faced that fact.”

Besides the Legacy Fund, the SIB also oversees the state pension funds -- the Teachers' Fund for Retirement, the Public Employees Retirement System -- as well as the Workforce Safety & Insurance Fund. RIO manages those investments and reports to the SIB.

Under RIO are some in-house investment managers as well as contracted outside money managers who are tasked with making investment decisions in line with the goals of the Legacy Fund, with the main goal being to prioritize investment returns.

Lunde is concerned that since the Legacy Fund investments are done through the same entity as the pension investments, strategic policy is adrift.

While managed by the same office that manages the pension funds, an RIO spokesman said Legacy Fund investments have never been pooled with the pension fund investments.

The fund is under a separate advisory board from those managing pension investments, with that being the legislature’s Legacy Fund and Budget Stabilization Advisory Board.

“While the Legacy Fund’s Investment Policy Statement says it may be pooled with other funds, it is managed separately from other client funds and has been since fiscal year 2015,” RIO Executive Director Jan Murtha said in a written response to several questions.

Lunde said his point is that the outside investment managers who get the deposits from both the Legacy Fund and pension fund pools don’t really see them any differently.

“The manager buys, let's say, some Apple stock for the Legacy Fund and some Apple stock for the pension fund,” Lunde said. “The deposits from the Legacy Fund are just treated like the deposits from the pension fund. Therefore, there is no strategic difference between the two. If you're the money manager, the strategy is the same for both pots of money.”

Overall, RIO manages around $21 billion including the Legacy Fund and the pension funds. It has 29 employees, with half of those on the Teachers’ Fund side. A total of six employees are dedicated to investments and two to risk management.

RIO is also trying to do more investment management in house, with a short-term goal to hire five more investment managers and another two operational staff.

That could cut some costs which go to outside money manager fees, as well as flesh out the backbone for more strategic investment and oversight.

On the money managers side, 27 investment managers are currently handling Legacy Fund investments.

At the close of last fiscal year, with the fund valued at $8.59 billion, a total of $38.13 million was paid out in fees to those outside investment managers.

There is a price to pay for investment, so perhaps hiring more in-house managers can make a dent in some of those costs.

RIO said internal investment teams working on pension or sovereign wealth fund investments are common in other states, mentioning Alaska, Arizona, Florida, North Carolina, Ohio, South Dakota, Texas, Virginia and Wisconsin, and that the cost of an internal team is low compared to fees to outside money managers.

“In addition to the cost savings, we’ll have greater control over investment strategies,” RIO Chief Investment Officer Scott Anderson said.

RIO eventually wants to bring around half of its investments under in-house management, with approval of the SIB and legislature, though says more complex investment strategies will still need to utilize outside managers.

(Editor’s Note: Brian Lunde worked with North Dakota News Cooperative in an advisory capacity for the North Dakota Poll.)

The North Dakota News Cooperative is a nonprofit news organization providing reliable and independent reporting on issues and events that impact the lives of North Dakotans. The organization increases the public’s access to quality journalism and advances news literacy across the state. For more information about NDNC or to make a charitable contribution, please visit newscoopnd.org. Send comments, suggestions or tips to michael@newscoopnd.org. Follow us on Twitter: https://twitter.com/NDNewsCoop.