Poll #2: Uncertainty found on ballot measures

Further education, robust debate needed for voter clarity

North Dakota voters appear uncertain and under-informed about a prospective ballot measure that could have far-reaching impacts on property taxes as well as a changes governing how future measures appear on ballots a year ahead of 2024 general elections.

The potential vote on eliminating property taxes, and a vote on requiring ballot measures to stick to a single subject as well be passed twice by voters, present changes to the status quo with long-term consequences for voters and state bureaucracy going forward.

According to the first North Dakota Poll, which surveyed 517 voters earlier in November, more voters don’t want to eliminate property taxes than do, and more voters hope to retain the power to bring citizen-initiated ballot measures through one round of voting.

Those were slim margins, however, and both poll questions showed significant numbers of undecided voters.

For those on either side of the debate, this signals a need to further educate the public about the potential real-life impacts of the changes as well as a need for continued polling and debate.

Local control

On the question of property tax elimination, supporters of that proposal say the question presented a false-dichotomy and that local control would remain whether property taxes are abolished or not.

“The poll was really not a measure of the public support for the measure,” said former Republican state representative Rick Becker, who heads a 25-member committee sponsoring a measure to eliminate property taxes. “It was it was more of a measure of the efficacy of the argument the opposition will use.”

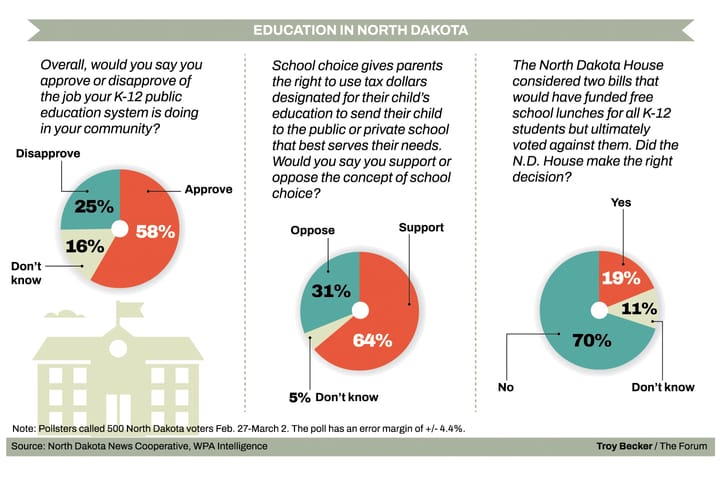

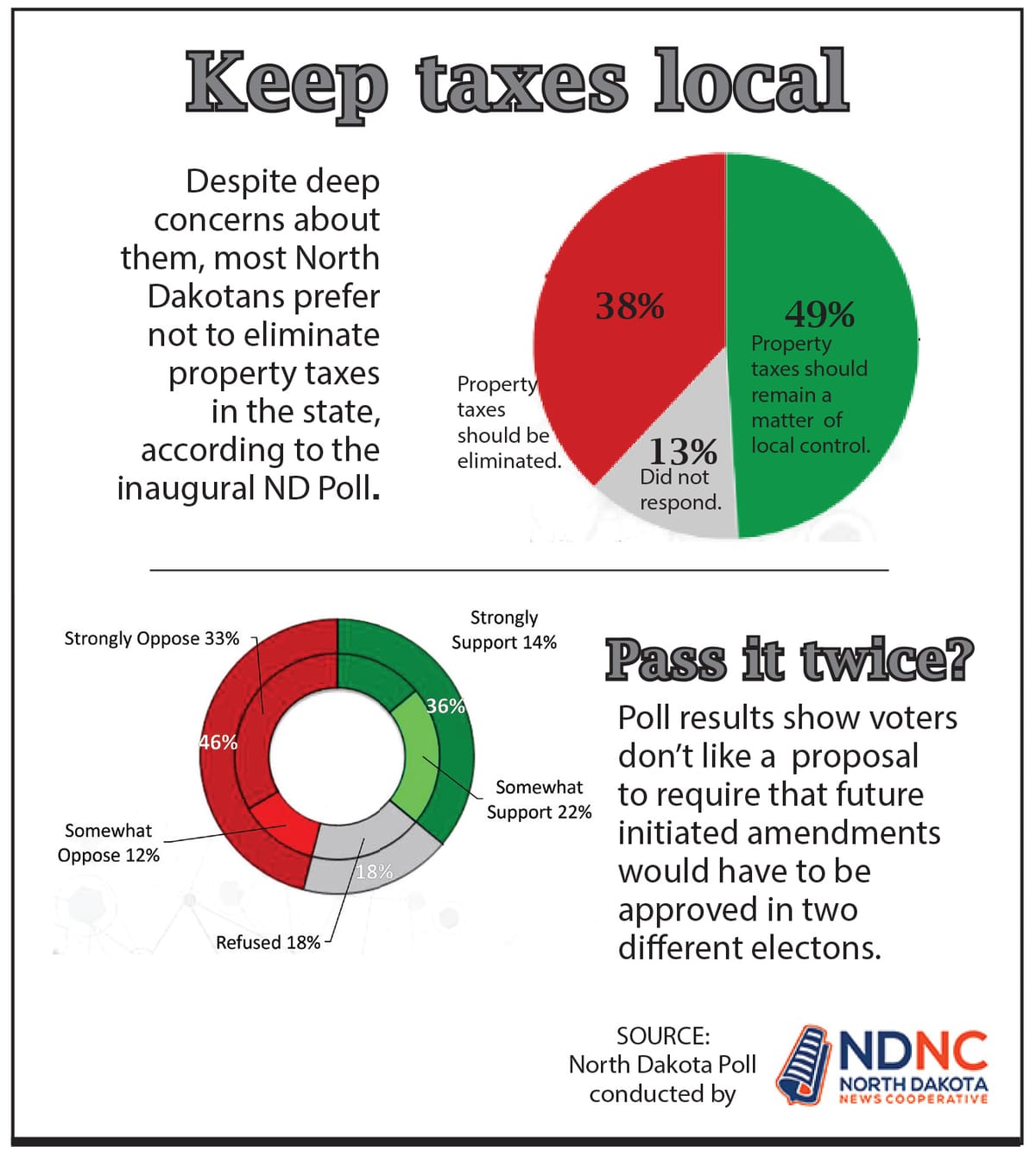

According to the poll, a plurality of voters, 49 percent, want property tax decisions to remain under local control, while 38 percent want them eliminated in favor of requiring the state legislature to replace lost revenue with other state funds. A significant total of 13 percent chose not to answer.

Becker said that the numbers would likely be reversed if the question was phrased differently, asking voters if they wanted to keep property taxes or eliminate them and retain local control.

That question of “local control” appears to be the main contention, both for opponents of the elimination who say local control will be lost, and supporters who say it will remain but that the revenue streams will just change.

Either way, the lost revenue on property taxes will need to come from somewhere.

Brian Lunde, an opinion research analyst for the North Dakota News Cooperative, which initiated North Dakota Poll, said the questions as presented came down to a “status quo versus change decision.”

Essentially that boils down to whether local governments would retain control on assessing and determining the use of property tax monies versus the state government and legislators taking control of how state funds are gathered through fees then directed to cities and counties to pay for schools, roads and other projects.

“Do I want to keep that in place? I may not like the property taxes I'm paying, but do I want somebody else to now take control of it?” Lunde said regarding the main intent of the question.

Donnell Preskey, a government and public relations specialist at the North Dakota Association of Counties (NDACo), which opposes the potential measure to eliminate property taxes, said the change could bring about a “cookie cutter” approach for counties across the state.

That approach, she said, could lead to a range of unknowns regarding how communities make investments in their own communities in the future if it is approved.

“The people who are closest to the issues, who understand the issues in the community, are your county elected officials,” said NDACo executive director Aaron Brist.

Brist said that “we need to do a lot more work in educating” voters about what the changes might mean for them.

“I think that the message going forward is that people really need to understand the important role that their property taxes play and in their own lives,” said Nick Archuleta, president of North Dakota United, an organization representing educators across the state.

“Nobody wants to think of the (state) legislature as their school board or their county commission, or their township board or their park board, and that's exactly what would happen if the measure goes through,” Archuleta said.

The measure may appear on the ballot in November 2024 as an initiated constitutional amendment under the North Dakota Prohibit Property Taxes Initiative.

As far as signatures gathered, Becker said the committee is around one-third of the way to its own goal of 45,000 signatures and needs a total of around 31,000 by July 2024 for the measure to be placed on the ballot.

Pass it twice or single subject?

In April, the North Dakota legislature placed a constitutional measure on the ballot in next year’s election that will require future measures initiated by citizens to pass twice to become law – first in the primary election and again in the general election.

Only one other state – Nevada – has passed such a law, and it did so in 1958.

A large percentage of voters polled – 46 percent – are opposed to the “pass it twice” measure, according to North Dakota Poll data.

Other aspects of that measure include requirements for ballot measures to stick to a single subject and a proposal for only allowing qualified electors to circulate petitions. Participants were not polled on these two parts of the measure.

State Senator David Hogue, one of the sponsors of Senate Concurrent Resolution 4013 which will be put before voters next year, said it wouldn’t have “overburdened the question” to present the single subject aspect as well.

“My belief is there is strong support among voters to limit constitutional measures to a single subject,” Hogue said, adding that he wasn’t inclined towards reading too much into the results since that part of the measure wasn’t included.

Again, Lunde said a lot of it boils down to a change in the status quo, and that the “pass it twice” portion of the measure is the most important and potentially restrictive change for voters.

“They should have just put out a clean constitutional amendment on limiting measures to a single subject by itself, but then they made it multiple subject themselves,” Lunde said. “It would have just sailed through.”

Like the property tax question, a large segment of respondents – 18 percent – declined to offer an opinion on the question, signaling a potential need for further information by voters.

While not agreeing with the content of the question, Hogue did indicate that he was glad the poll was conducted and said it is helpful for “getting the voters to think about these issues” since they often don’t get presented until the weeks before an election.

“And then they're not as informed as they otherwise would be, if you have, you know, more robust public discussion,” Hogue said.

A total of 71 percent of the voters polled in the North Dakota Poll plan to vote in the 2024 elections and 59 percent have voted in the past four general elections. The poll had a margin of error of plus or minus 4.3 percent.

The first North Dakota Poll, which plans to be a quarterly venture, was sponsored by Forum Communications Co., the North Dakota Broadcasters Association and the North Dakota Petroleum Council.

WPA Intelligence, which conducted the polling, is a leading national provider of survey research, predictive analytics, and data management technology to assist in survey design, representative sampling, programming, fielding and data analysis.

The North Dakota News Cooperative is a nonprofit news organization providing reliable and independent reporting on issues and events that impact the lives of North Dakotans. The organization increases the public’s access to quality journalism and advances news literacy across the state. For more information about NDNC or to make a charitable contribution, please visit newscoopnd.org.